The Tufts-CEVR HEOR Leaders Survey: Perspectives on Organizational Support and Evidence Opportunities

Peter J. Neumann, ScD,a Grace Hatfield, BA,a Lu Shi, PhD,a Tom Hughes, BScPharm,b PhD Matt Seidner, BS,a Paige Lin, PhD.a

a Center for the Evaluation of Value and Risk in Health, Institute for Clinical Research and Health Policy Studies, Tufts Medical Center

b Global Medical Affairs and Evidence Generation, argenx

Introduction

The field of health economics and outcomes research (HEOR) is undergoing substantial change, with some pharmaceutical companies reducing or restructuring their HEOR teams.¹ It is unclear whether these changes reflect an industry-wide de-emphasis of the function, a belief that HEOR is better located within other organizational departments (e.g., Market Access), or other reasons. To better understand these changes and prospects for the field, we surveyed 100 US-based HEOR leaders in pharmaceutical companies.

Methods

We conducted a brief (10-minute) survey of senior professionals in HEOR departments at US-based pharmaceutical companies from October 6 to November 3, 2025, to understand their views about various U.S. government health policies and trends in the HEOR field. Here we report on respondents’ attitudes about trends in HEOR within pharma. Previously, we reported on respondents’ views on various health policy topics.

We pilot-tested the survey with seven experts and established a larger, convenience sample of HEOR experts at leading pharmaceutical companies. We prioritized individuals at large pharmaceutical companies based on 2024 revenue data and their membership in PhRMA or the National Pharmaceutical Council and included individuals in selected smaller companies who subscribe to Tufts-CEVR databases. To ensure high-level insights, we sought to identify heads of HEOR departments. We invited 100 professionals from 72 companies to participate (one per company, two to three for larger organizations). Fifty-nine recipients from 46 companies completed the survey.

Results

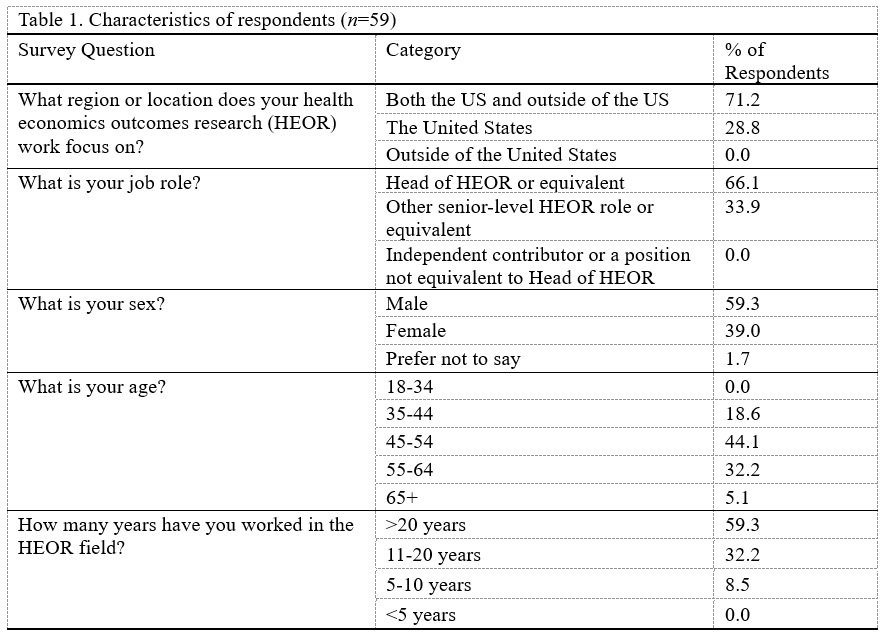

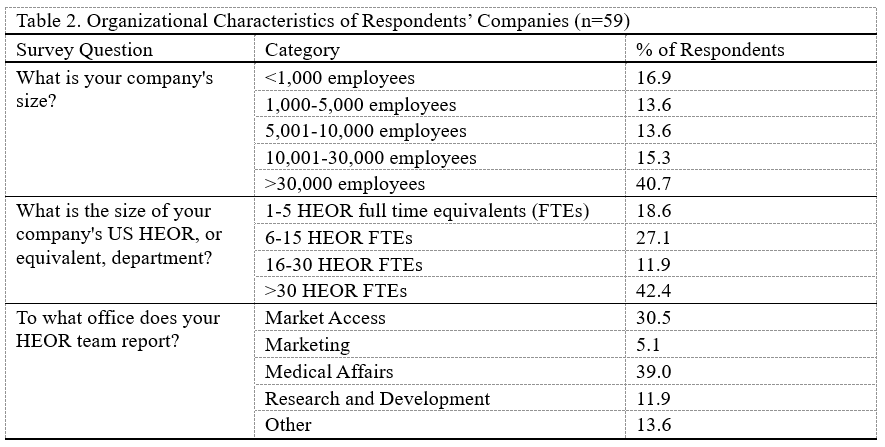

Of the 59 participants, 59% were male, 81% were 45 years old or older, and 59% had been working in the HEOR field for over 20 years (Table 1). Seventeen percent worked at small companies (<1,000 employees), 42% at medium-sized companies (1,000-30,000 employees), and 41% at large companies (>30,000 employees) (Table 2). Respondents’ HEOR teams were situated most commonly within companies’ Medical Affairs (39%), Market Access (30%), or R&D (12%) departments.

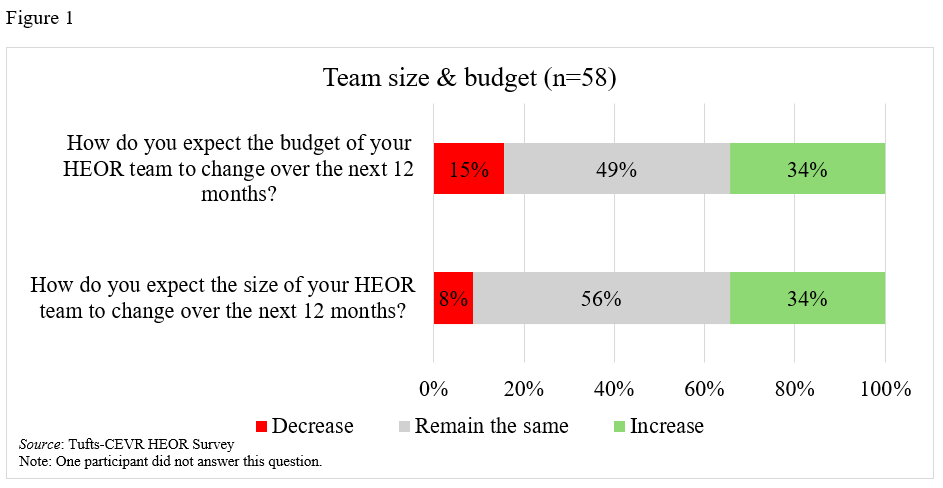

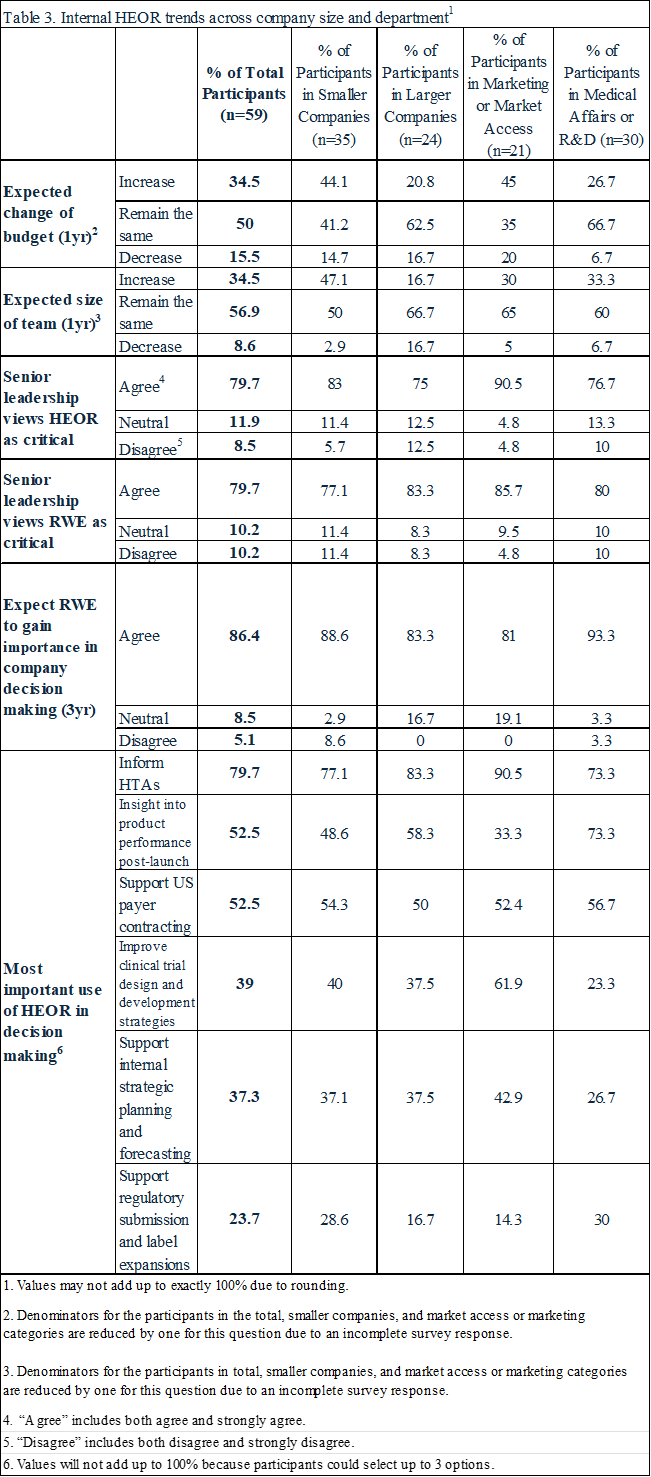

Fifty-three percent of respondents anticipated that their department’s size and budget would remain the same in the next year, while 34% predicted increases, and 13% decreases (Table 2, Figure 1). Respondents from larger companies (>30,000 employees) were less likely to expect growth in their HEOR team’s size and budget (fewer than 20% from larger companies predicted an increase versus nearly 50% from small to medium-sized companies; Table 3). HEOR respondents in Market Access/Marketing were more likely to state that HEOR budgets would increase (45% vs. 27% for those in Medical Affairs/R&D; Table 3).

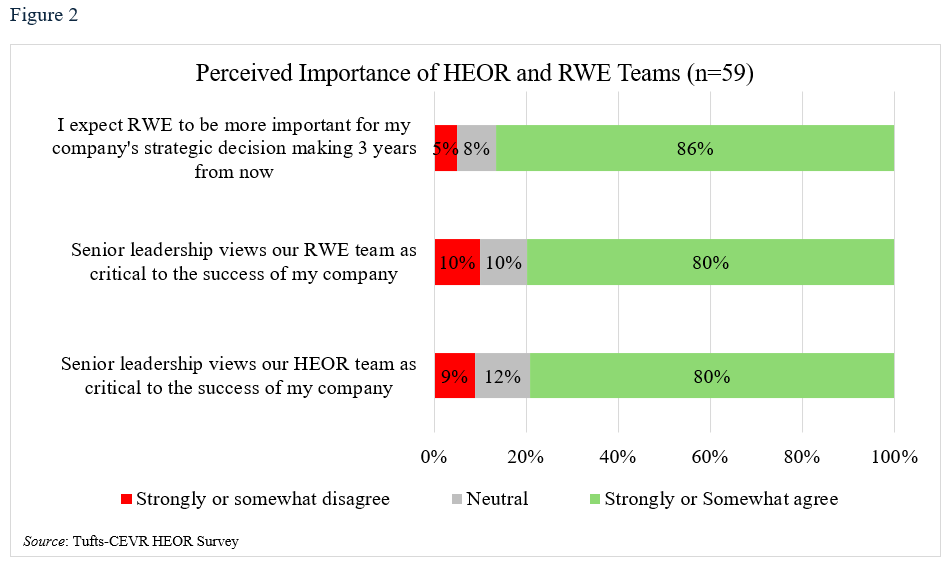

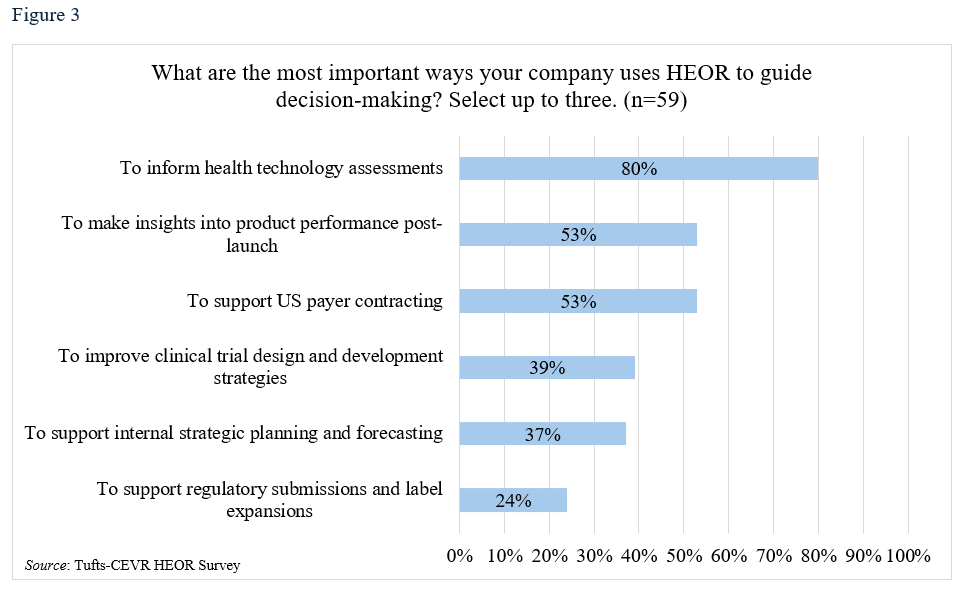

Eighty percent said their companies’ senior leaders believed HEOR and RWE were critical to their firm’s success, and 86% predicted that HEOR would become increasingly important in RWE-based strategic decisions (Table 3, Figure 2). HEOR was seen as important in informing health technology assessment (HTA) (respondents chose up to three of five options and 80% selected this one), followed by supporting product planning post launch (53%), payer contracting (53%), clinical trial design (39%) and internal planning (37%).

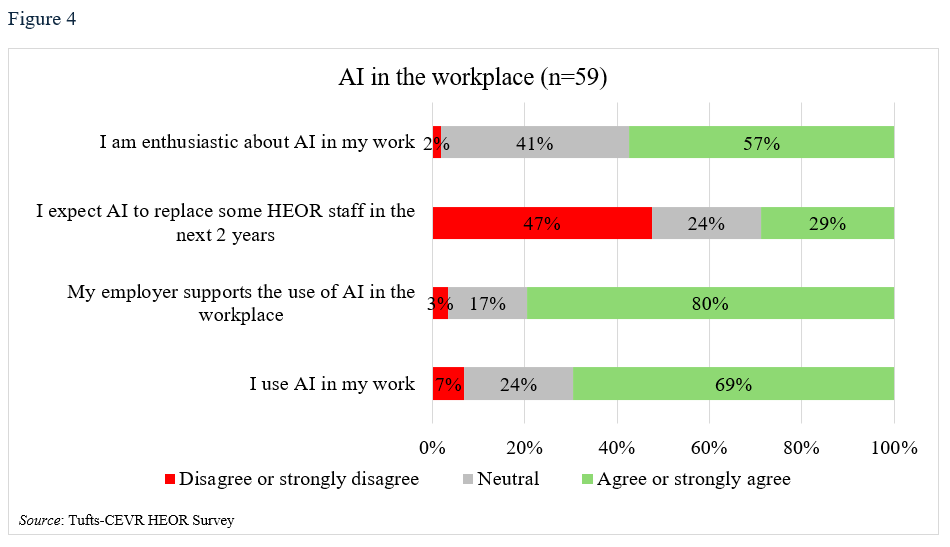

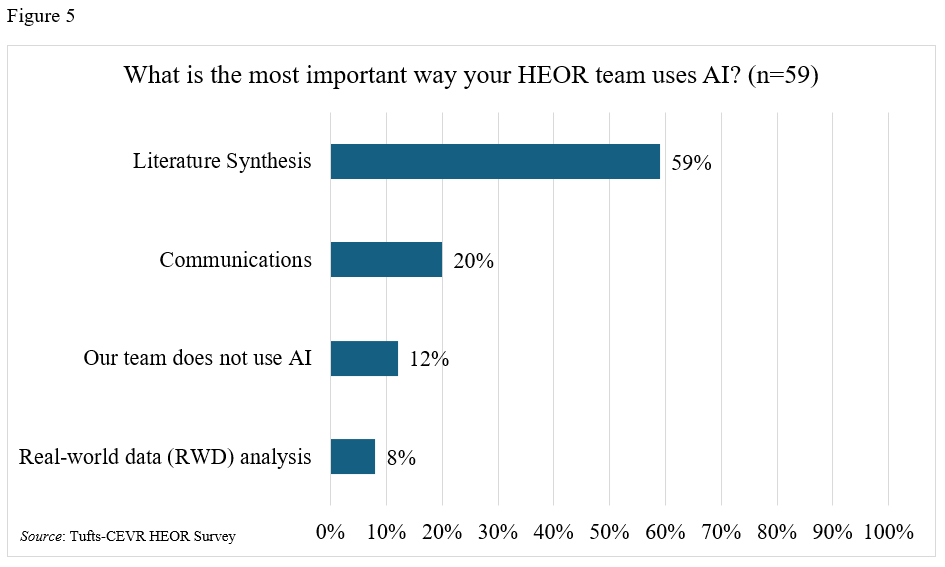

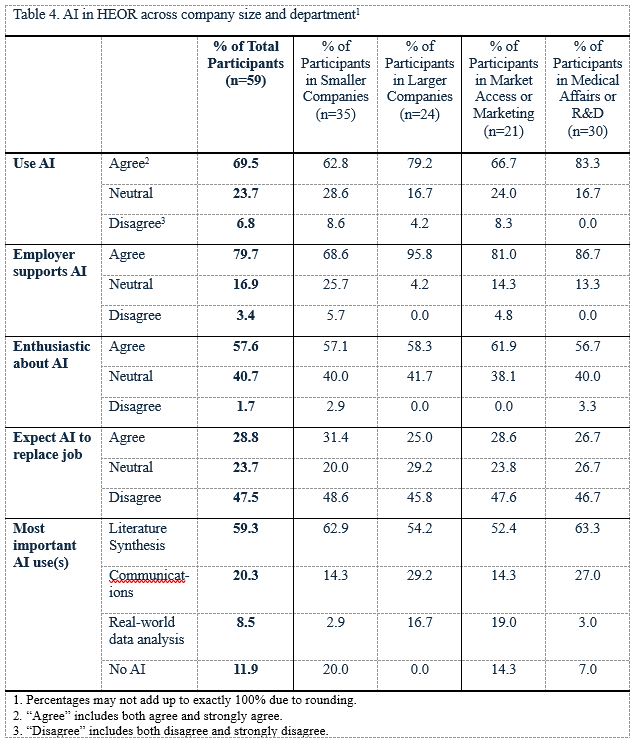

Most respondents (69%) reported using AI in their work (Table 4, Figure 4), especially for literature syntheses (Table 4, Figure 5). A majority (80%) stated that their employers supported using AI in the workplace, and just over half (57%) were enthusiastic about doing so. Still, almost a third believe that some HEOR jobs would be replaced by AI in the next 2 years. Respondents from large companies and those whose HEOR teams were housed in Medical Affairs or R&D departments were more likely to use AI (79% use AI in large companies vs 63% in small companies; 83% versus 67% for those in Market Access/Marketing).

Discussion

Our survey highlights several key lessons for HEOR professionals in pharma.

HEOR is resilient but is being tested. Our survey suggests that HEOR is fundamentally sound: 80% of respondents agreed that senior leaders view HEOR as a critical function. Still, while HEOR teams are not in danger of disappearing and will survive further restructuring, they are being challenged. Many respondents, especially those at larger companies, anticipate flatter budgets ahead.

Faced with this prospect, HEOR leaders should focus on their influence rather than team size. That means translating technical analyses into persuasive narratives and linking HEOR output to key leadership decisions in terms of pricing, access, label expansion, and portfolio prioritization. It also underscores the importance of HEOR teams improving their communication skills and cross-functional fluency.

HEOR is most valuable “downstream,” but there are “upstream” opportunities. Most respondents stated that HEOR’s most important use was to inform HTA and other post-launch activities, though more than a third also cited HEOR’s influence on trial design and internal planning. These results suggest that HEOR teams should continue to focus on post-approval activities, but they also highlight additional opportunities in clinical development – e.g., to serve as a bridge between R&D, Medical, and Market Access. HEOR teams can, for example, focus more on early evidence planning (e.g., for endpoint selection, comparators and trial populations). If HEOR is not involved in crafting a COA/PRO strategy and focused on post launch, they are missing a significant opportunity to support the commercialization of a drug at launch.

Large and small pharma may have somewhat different HEOR challenges. Respondents from smaller companies were more optimistic about HEOR growth prospects. Large pharma HEOR teams might broaden their focus beyond traditional economic evaluation of newly approved assets to include portfolio-level prioritization, lifecycle management, and Medicare drug price negotiation, while smaller firm HEOR teams continue to concentrate on supporting the value proposition for their fewer assets.

HEOR leaders are using AI but may not be leveraging its potential. Our survey highlights that AI use is already widespread by HEOR teams, mainly for literature synthesis. Still, views on its promise seemed somewhat mixed: that just over half of respondents were enthusiastic about AI, for example, and almost a third stated that AI would replace HEOR jobs. Our results suggest that HEOR teams might use AI more intentionally with opportunities, for example, in communications and data analytics, as both of these applications seem underused by HEOR teams.

Acknowledgment

This research was funded by argenx, Inc.

Download

Report (PDF)

References

1. Ramsey S. Big Pharma Says “Thanks, but No Thanks” to Their Own HEOR Groups. Curta; 2024.