The Tufts-CEVR HEOR Leaders Survey: Health Policy Challenges and Opportunities

Peter J. Neumann, ScD,a Lu Shi, PhD.,a Grace Hatfield, BA,a Tom Hughes, BScPharm,b PhD, Matt Seidner, BS,a Paige Lin, PhD.a

a Center for the Evaluation of Value and Risk in Health, Institute for Clinical Research and Health Policy Studies, Tufts Medical Center

b Global Medical Affairs and Evidence Generation, argenx

Introduction

This is the first installment in a series we’ll be disseminating over the coming months on how industry HEOR departments are adapting to a new health care environment marked by significant health policy change.

Methods

We conducted a brief (10-minute) survey of HEOR leaders at US-based pharmaceutical companies to understand their views about various U.S. government and commercial health policies and trends in HEOR. In this post, we report on respondents’ attitudes about government policies. Separately, we’ll post about their views on prospects for HEOR inside pharmaceutical companies.

We pilot-tested the survey with seven experts and established a larger, convenience sample of US-based HEOR experts at leading pharmaceutical companies. We prioritized individuals at large pharmaceutical companies based on 2024 revenue data and their membership in PhRMA or the National Pharmaceutical Council and included individuals in selected smaller companies who subscribe to Tufts-CEVR databases. To ensure strategic insights, we sought to identify heads of HEOR departments. We invited 100 professionals from 72 companies to participate (one per company, two to three for larger organizations). Fifty-seven recipients from 44 companies completed the survey.

Results

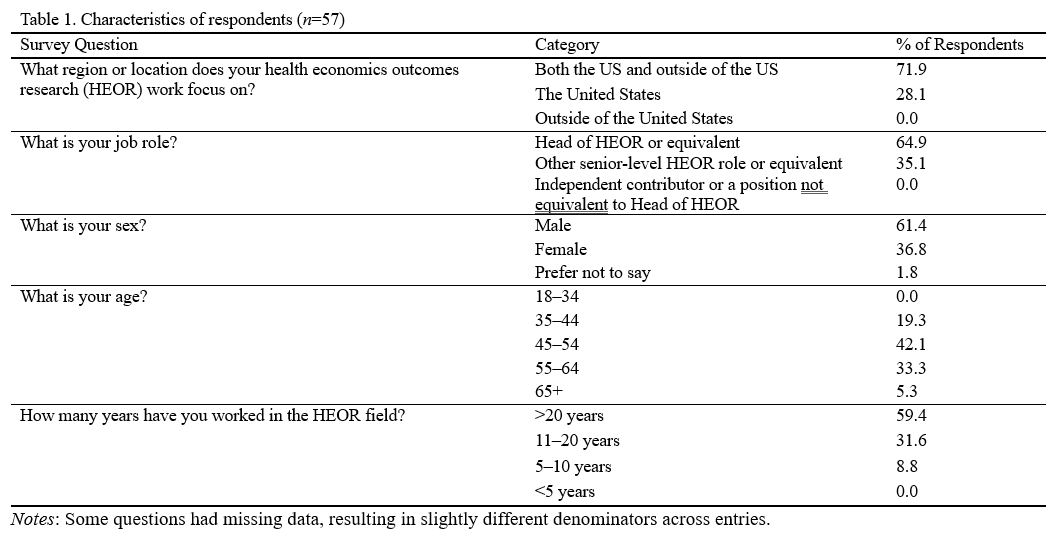

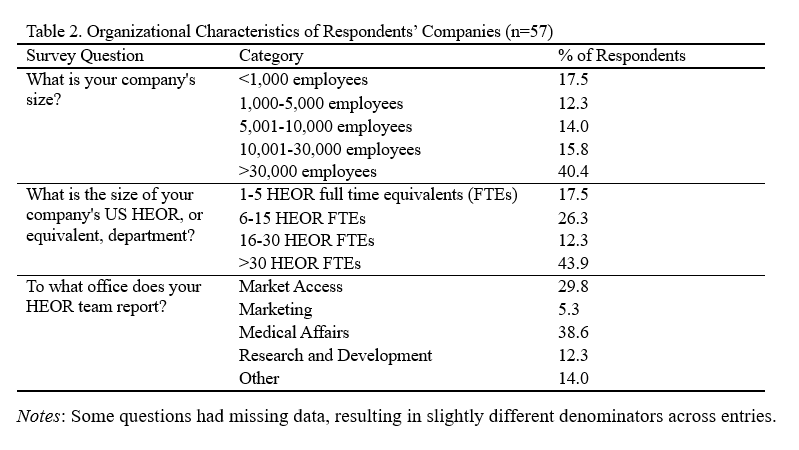

Of the 57 respondents, 61% were male, 81% were 45 years old or older, and 59% had been working in the HEOR field for over 20 years (Table 1). Forty-two percent worked at medium-sized companies (1,000-30,000 employees), 40% at large companies (>30,000 employees), and 18% at small companies (<1,000 employees) (Table 2). Respondents’ HEOR teams were situated most commonly within companies’ Medical Affairs (39%), Market Access (30%), or R&D (12%) departments.

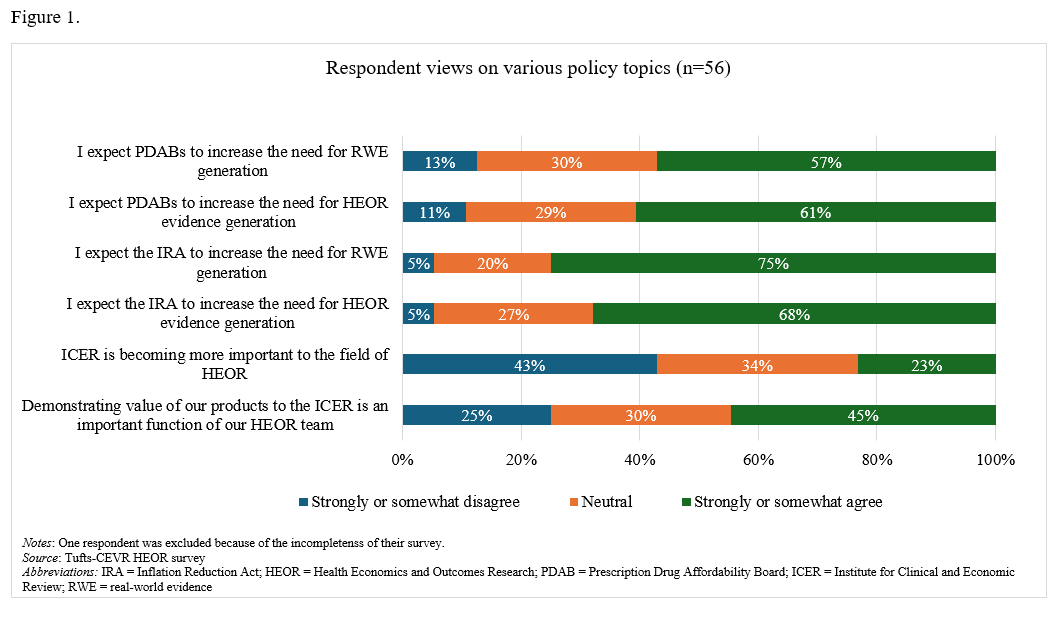

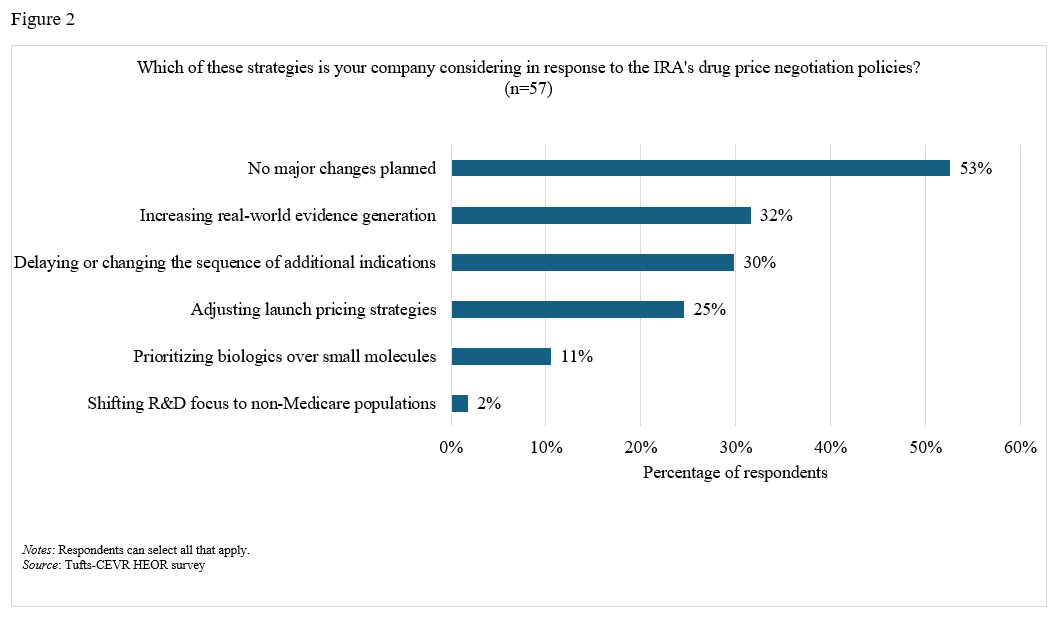

On the impact of the IRA and PDABs. A majority (68%) of respondents stated that they somewhat or strongly agreed that the Inflation Reduction Act (IRA) has driven a greater need for HEOR evidence generation (Figure 1). Eleven percent reported that their companies are prioritizing biologics over small molecules in response to the IRA, while 30% reported that their companies are delaying or changing research plans for additional indications (Figure 2). Over half of respondents expect Prescription Drug Affordability Boards (PDABs) to further increase the demand for HEOR (57%) and real-world evidence (RWE) (61%).

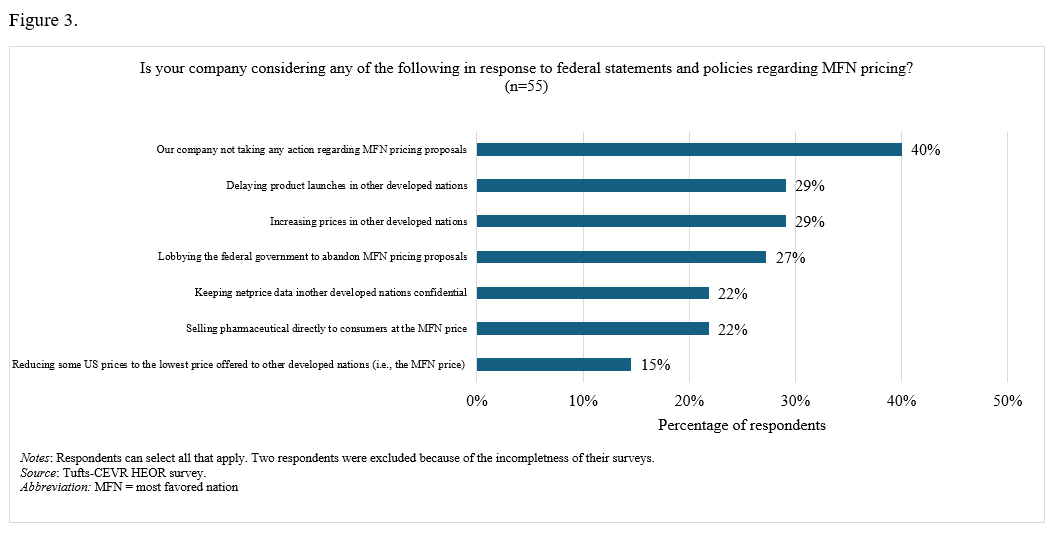

On the impact of MFN policies. In terms of anticipated behavior regarding “Most-Favored-Nation” (MFN) pricing policies, 29% reported that their companies would delay product launches or increase prices in other developed nations, 27% noted that their companies were lobbying the federal government to abandon MFN proposals, and 39% stated that their companies had taken no action (Figure 3).

On the importance of ICER. Twenty-three percent of respondents strongly or somewhat agreed that the Institute for Clinical and Economic Review (ICER) is gaining importance, while 43% disagreed and 34% were neutral on the matter.

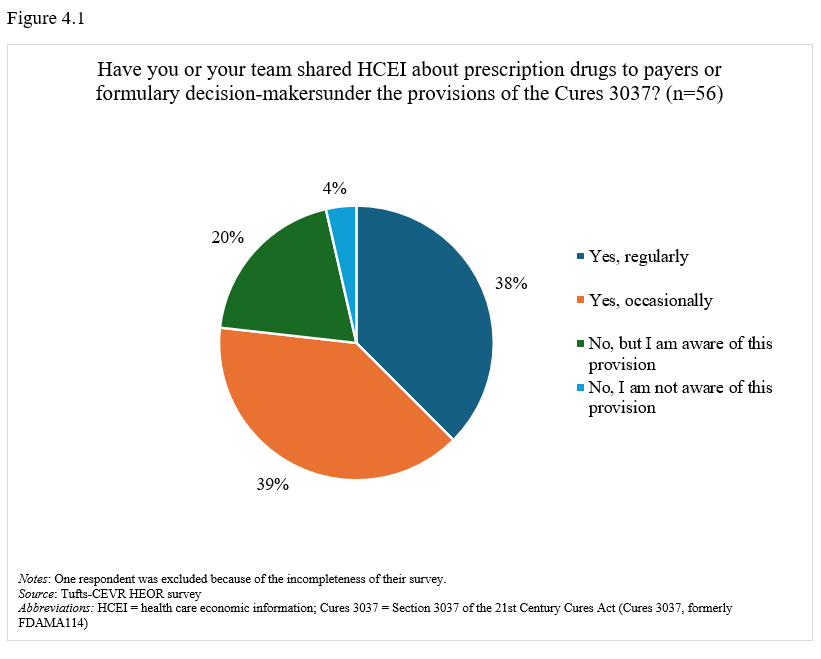

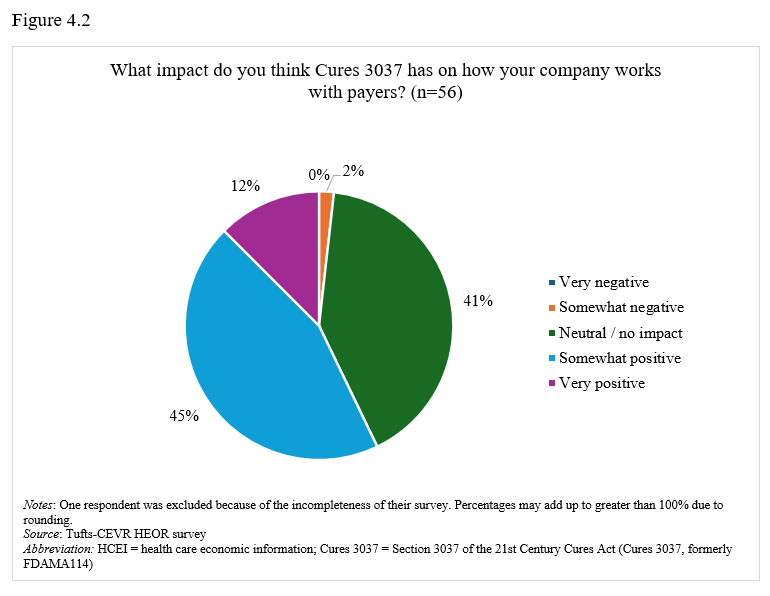

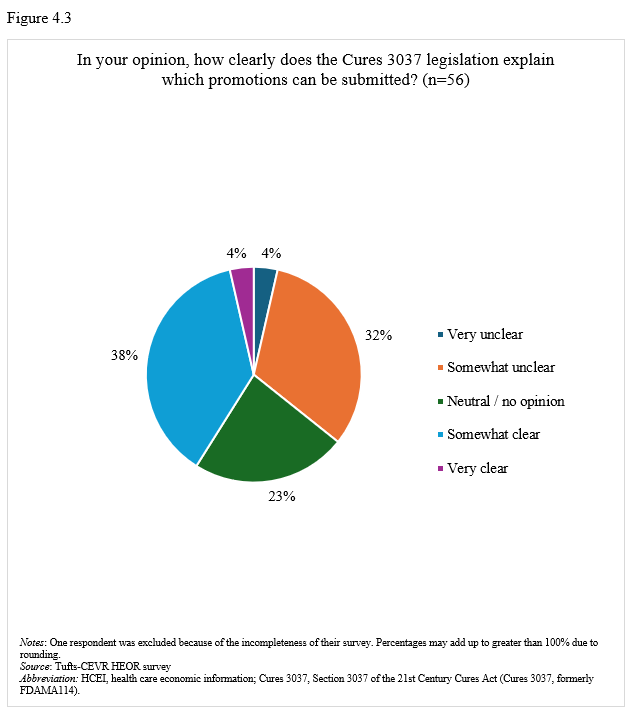

On promotion of health care economic information. Seventy-seven percent of respondents stated that their companies have regularly or occasionally shared health care economic information (HCEI) with payers or formulary decision-makers under 21st Century Cures Act, Section 3037 (formerly FDAMA 114) provisions (Figure 4.1). Most respondents (58%) viewed Section 3037 somewhat or very positively (Figure 4.2), though 42% found guidance somewhat or very clear, while 36% considered it somewhat or very unclear (Figure 4.3).

Differences in responses by company size. Respondents from large companies were somewhat more inclined to believe PDABs will increase the need for HEOR/RWE. In terms of views about ICER, respondents from large companies were slightly more inclined to think it important to demonstrate value to ICER but less inclined to think ICER becoming more important. They were also less apt to say they regularly use 3037 to promote HCEI.

Differences by organizational reporting structure. Respondents whose HEOR teams report to Medical Affairs or R&D (compared to those reporting to Market Access or Marketing) were less inclined to believe ICER is becoming more important, more inclined to use 3037 and more inclined to say 3037 has had a positive impact.

Discussion

Our survey results indicate that most HEOR leaders believe that recent health policy and commercial changes related to the IRA and PDABs will significantly increase demand for both RWE and HEOR evidence generation. However, this expectation appears to be translating only gradually into widespread strategic and tactical change, as many companies remain cautious despite a growing emphasis on evidence-based decision-making and value demonstration among payers and policy makers. Although some respondents reported early or anticipated responses to MFN- and IRA-related pricing pressure, the most common response was that their companies were not yet taking action. Taken together, these findings suggest that while firms are actively monitoring health policy changes, many companies seem to be adopting a “watchful waiting” approach rather than undertaking immediate strategic and tactical change.

Respondents reported mixed opinions regarding the importance of ICER. Although 45% reported that engaging with ICER is an important HEOR function, a sizeable proportion (43%) disagreed that ICER is becoming more influential in the US market.

Our survey also provides insight into how HEOR professionals are applying Cures Section 3037 in payer communications. Respondents reported increasing use of Section 3037 to support HCEI and mostly positive views about the statute, presumably reflecting greater clarity about communicating RWE and economic modeling. However, some uncertainty remains regarding the proper interpretation and implementation of the provision and additional guidance might improve consistency in application.

Respondents from large companies were more likely to anticipate increasing demand for HEOR/RWE and value evidence, perhaps reflecting their more extensive experience or responsibilities, and interestingly, they were less likely to see ICER’s influence growing or to use FDA 3037 routinely. HEOR teams reporting to Market Access or Marketing were more likely to view ICER as increasingly important, but less likely to use Section 3037 and to view it positively.

Advice for the field

The IRA and PDABs create opportunities for HEOR. The IRA and PDABs might be viewed as health policy shifts which create important openings for HEOR as federal and state officials are increasingly scrutinizing the evidence base underlying drugs with high spending. Ideally, HEOR can add value by informing drug development and commercial. HEOR can also provide intelligence from real world evidence and support scenario planning. Achieving these aims will require strong leadership in HEOR departments.

Embed HEOR earlier in clinical development. There are opportunities for HEOR to move “upstream” as value evidence is increasingly needed before launch and across the product lifecycle—not simply for post-approval access and reimbursement. For example, HEOR can help develop companies’ clinical programs and selection of drug comparators, end points, and patient population, as well as inform negotiations and indication investment decisions.

ICER assessments are informative but incomplete guides to value. Pharma companies should not “over anchor” on ICER evaluations but rather consider that the US offers a decentralized and pluralistic landscape for drug value assessments. ICER remains influential, but CMS, PDABs, and private payers do not converge on a single framework, a reality that may be reinforced with the advent of MFN policies.

Section 3037 offers opportunities to promote health care economic information but there is a need for HEOR leadership to highlight its value and drive its use. Companies are taking advantage of channels to communicate HEOR information proactively to payer audiences, but there is a need and opportunity for HEOR leaders to increase its use. HEOR teams within companies should partner closely with legal and medical affairs to foster more clarity and confidence in using the provision.

Acknowledgment

This research was supported by argenx, Inc.

Downloads

Report (PDF)

Appendices (PDF)