By Fariel LaMountain, BA, Molly T. Beinfeld, MPH, and James D. Chambers, PhD, MPharm, MSc

September 12, 2023

Introduction

The introduction of Amgen’s biosimilar Amjevita™ (adalimumab-atto) has challenged the position of AbbVie’s Humira® as the top-selling pharmaceutical in the US. In this blog we take an early look at how US payers covered Amjevita relative to Humira and explored how Humira’s net price changed following Amjevita’s introduction.

Data Sources

For payer coverage information, we analyzed data in the Tufts Medical Center Specialty Drug Evidence and Coverage (SPEC) Database, which includes specialty drug coverage policies issued by 18 large US commercial health plans (representing roughly 70% of commercially covered lives). For pricing trends, we used SSR Health’s reported net prices for 2018-2023.

Findings

Drug coverage

Payers issued more coverage policies for Humira than they issued for Amjevita. Fifteen of 18 payers (83%) issued Humira coverage policies (120 coverage decisions, e.g., Aetna’s decision to cover Humira for rheumatoid arthritis); 11 (61%) issued Amjevita coverage policies (88 coverage decisions).

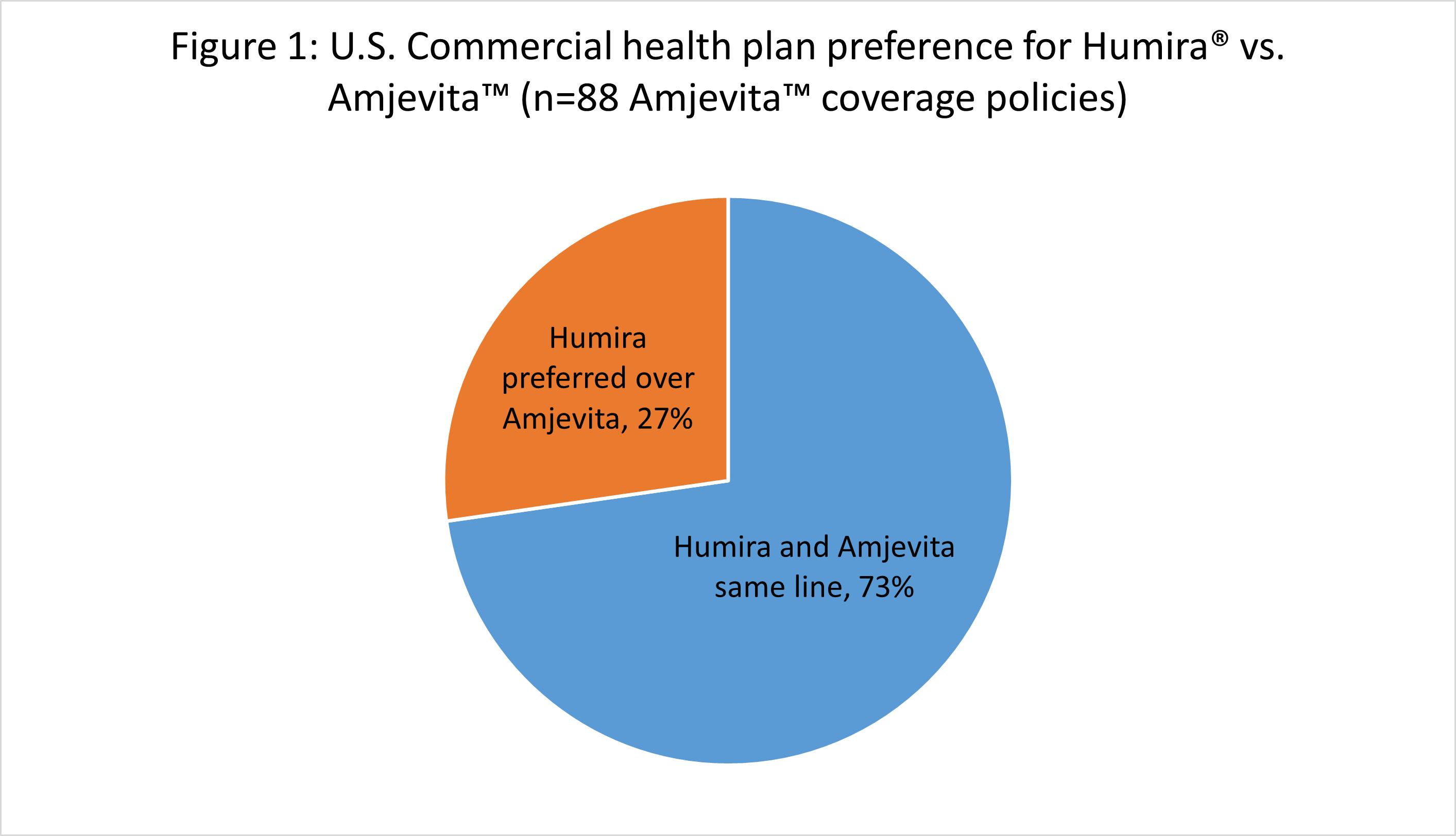

Of the 88 instances where payers issued coverage for both Humira and Amjevita for the same indication, 24 (27%) preferred Humira over Amjevita, i.e., plans required patients to first try and experience treatment failure with Humira before granting access to Amjevita (Figure 1). In 64 (73%) instances, plans covered Amjevita on par with Humira, i.e., plans allowed the prescriber to choose between Amjevita or Humira. In no instances did we find that a plan required preferred Amjevita over Humira.

Source: Authors’ analysis, Tufts Medical Center’s Specialty Drug Evidence and Coverage (SPEC) database coverage data for Humira® and Amjevita™ as of April 2023

Pricing

Amgen opted for a dual-pricing strategy for Amjevita, with one price point 55% lower than Humira’s, the second 5% lower. Amgen’s rationale for this approach is that it would prove to be attractive to both Pharmacy Benefit Managers (PBMs), and to those purchases who prefer a lower net price. This strategy would allow Amgen to offer PBMs large rebates on the pricier version (PBMs profit in part from rebate sharing), and separately to offer the cheaper version to those purchasing the drug directly.

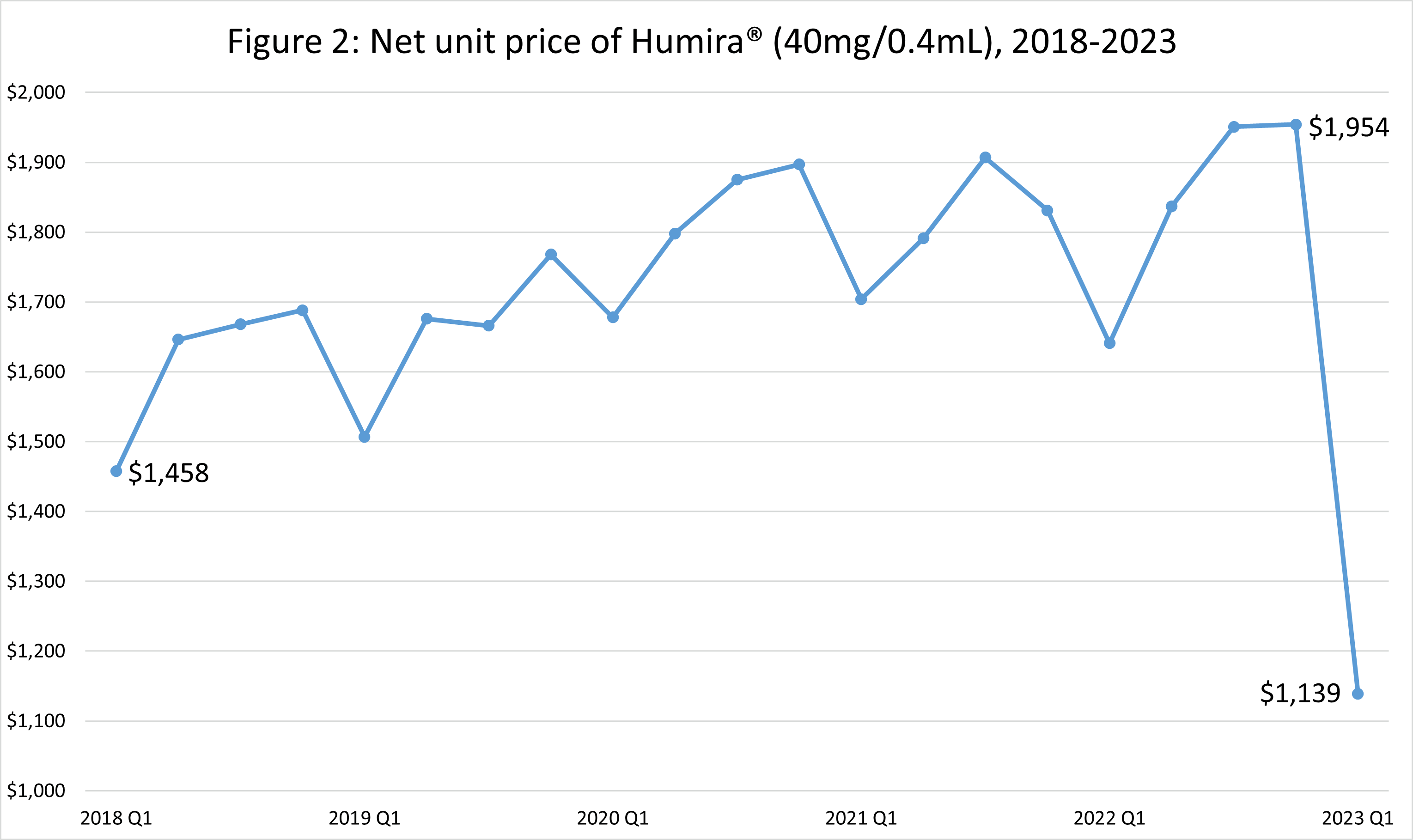

Humira’s net price increased steadily from 2018 Q1 to 2022 Q3. Following Amjevita’s introduction Humira’s net price dropped 58%, $1,954 to $1,139 (Figure 2).

Source: Authors’ analysis of SSR Health U.S. prescription brand pricing data tool’s quarterly net unit pricing data for Humira®, 2018 Q1 through 2023 Q1

Conclusions

Amjevita’s introduction had a mixed effect on Humira.

With respect to payer coverage, plans most often covered Amjevita on par with Humira, although roughly one quarter of plans preferred Humira over Amjevita. Notably, at the time of analysis, no plans preferred Amjevita over Humira, despite Amgen’s aggressive dual pricing strategy.

With respect to pricing, Abbvie appears to have substantially reduced Humira’s net price in response to Amjevita’s introduction.

Humira will face stiff biosimilar competition in the upcoming months. Watch this space for further analysis.

More on the Specialty Drug Evidence and Coverage (SPEC) Database

The Tufts Medical Center Specialty Drug Evidence and Coverage (SPEC) Database is a first-of-its-kind resource designed to enhance the transparency of commercial health plan specialty drug coverage. SPEC draws on publicly available medical and pharmacy coverage policies issued by 18 of the largest commercial health plans. Health plans in SPEC cover roughly 170 million lives, or 70% of the market. SPEC includes 399 drugs manufactured by 105 different pharmaceutical and biotech companies. We keep SPEC timely by updating its contents every four months. SPEC includes information on three principal components: (1) health plan coverage decisions, (2) the evidence health plans cite in their coverage policies, and (3) specialty drug attributes.

Access to SPEC is through the CEVR Sponsorship program. Access to the online search portal of the SPEC database is also available for individuals from academic organizations for non-commercial use of the data. Contact James Chambers (jchambers@tuftsmedicalcenter.org) for more information.