By Fariel LaMountain, BA, Molly T. Beinfeld, MPH, and James D. Chambers, PhD, MPharm, MSc

March 14, 2024

Introduction

Uncertainties in the underlying evidence supporting surrogate endpoints, delays in confirmatory trials, and drugs’ high costs, have led to increasing criticism the Food and Drug Administration’s (FDA) Accelerated Approval (AA) program. The AA program was launched to expedite the approval of drugs for serious conditions that provide a meaningful advantage over available therapies. The FDA approves drugs in the AA program based on a surrogate endpoint that is reasonably likely to predict clinical benefit. For drugs the FDA approves through the AA program, manufacturers are required to complete confirmatory trials to verify that the drug provides clinical benefit within an appropriate timeline (determined by the FDA). If an AA drug successfully completes the confirmatory trials FDA will grant the drug traditional approval; failure to demonstrate clinical benefit may result in removal from the market.

In this blog, we explore how AA drugs challenge health plans by examining how commercial health plan cover them by:

- Identifying when plans impose restrictions beyond the FDA label, highlighting differences in step therapy requirements

- Comparing coverage of oncology and non-oncology AA drugs

- Comparing coverage of orphan and non-orphan AA drugs

We found that payers often defer to the FDA label in determination of coverage for AA drugs. When plans do impose coverage limits on AA drugs, non-oncology and/or orphan drugs tend to face additional restrictions.

Data Sources

We used the Tufts Medical Center Specialty Drug Evidence and Coverage (SPEC) Database, which includes coverage policies for specialty drugs issued 18 large US commercial health plans. More information on the SPEC Database is included at the end of this article.

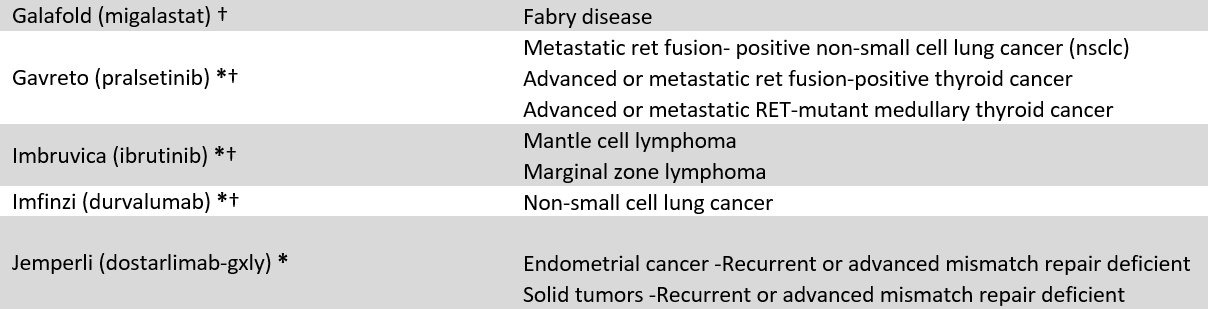

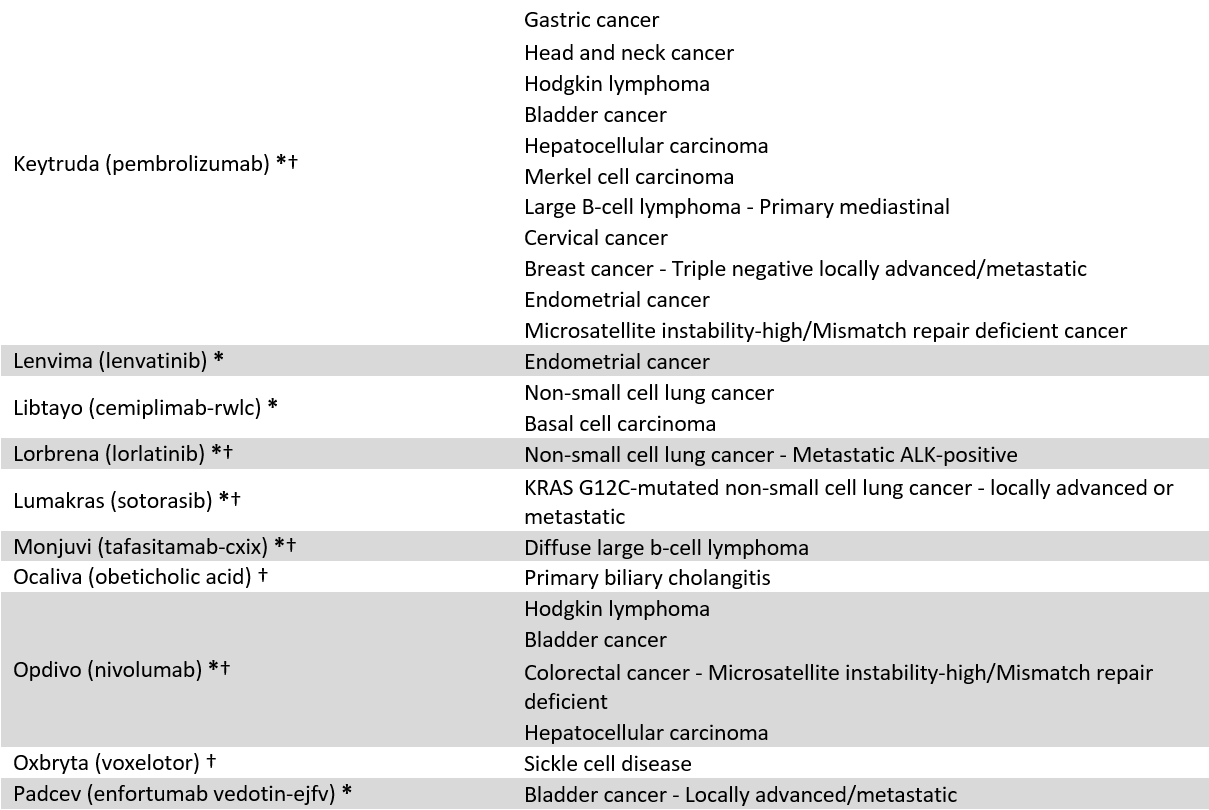

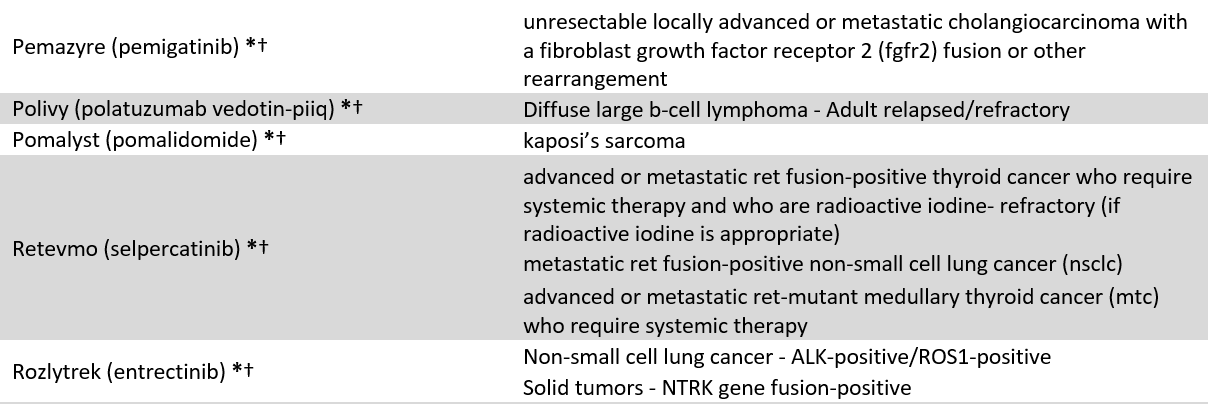

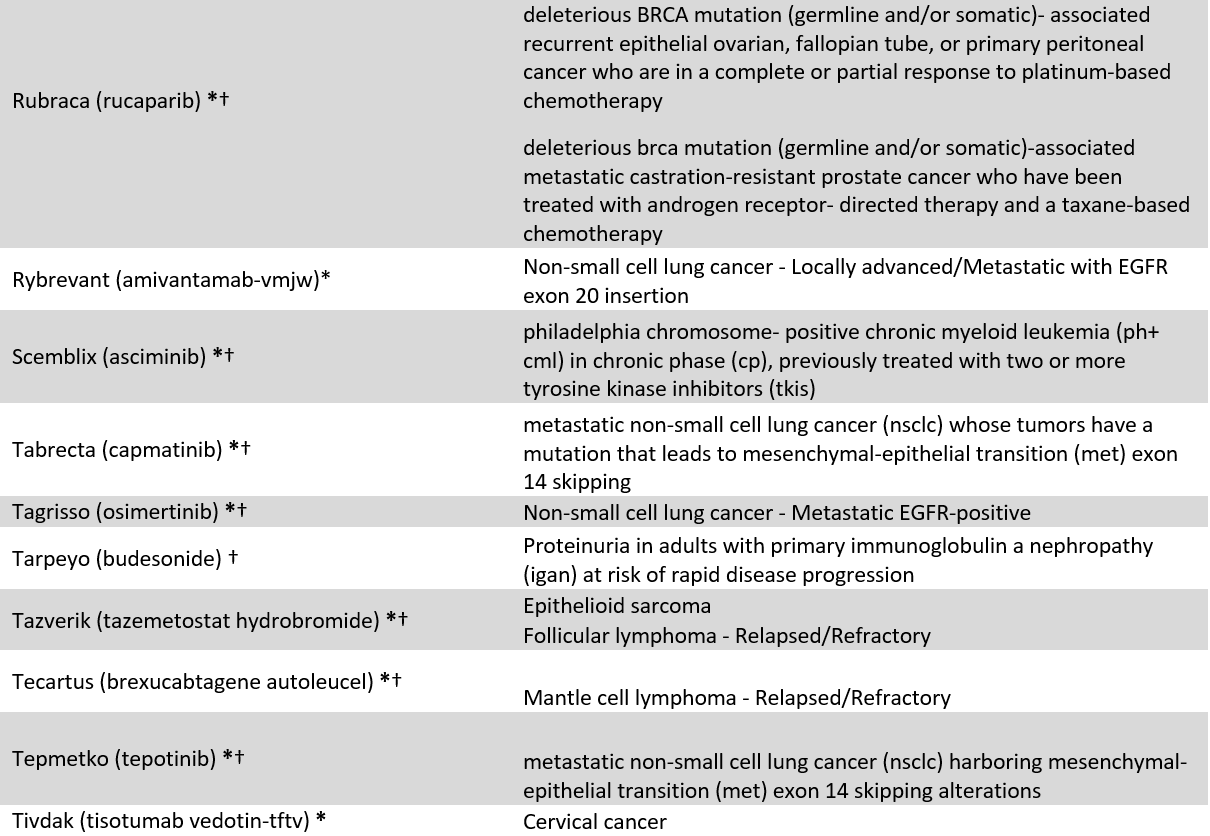

We identified 60 drugs granted FDA-AA status between 2016 and 2021 with at least 10 coverage policies issued by 18 large US commercial payers (current April 2023, see appendix 1). Because FDA often approves drugs for multiple uses, our sample include 86 drug-indication pairs (FDA approved 13 of the 60 included drugs for multiple indications). Our sample included 1,239 coverage policies, e.g., BCBSFL’s coverage of Retevmo for RET Fusion-Positive Thyroid Cancer. To explore coverage differences between AA drugs, we stratified the results by oncology vs. non-oncology, and orphan vs. non-orphan drugs.

Findings

Of the included 1,239 coverage policies, plans provided some degree of coverage for AA drugs in 1,206 (97%) policies; plans did not cover the drug in 33 (3%) policies. 89% (n=1,079) of active coverage decisions were for oncology indications and 70% (n=841) for orphan indications.

Payer coverage restrictiveness

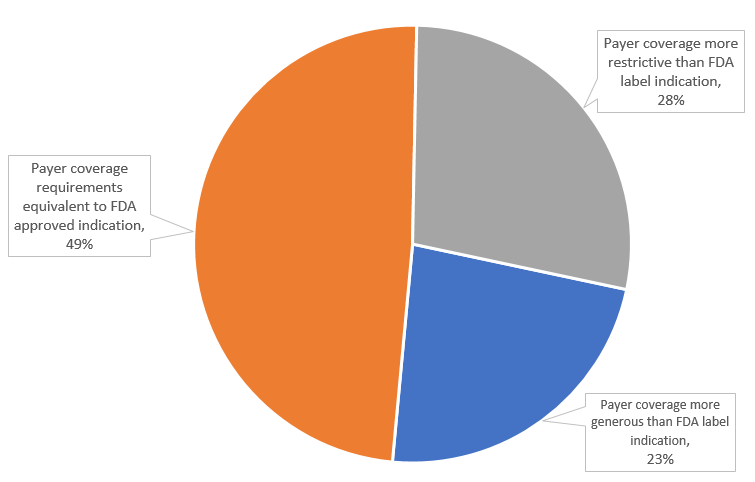

We found that 338 (28%) of plan’s AA drug coverage policies included restrictions beyond the FDA label (subgroup restrictions were the most common restriction type). 589 (49%) were equivalent to the drug’s FDA label indications, i.e., the plan covered the drugs for the same patient population as FDA approved it, and 279 (23%) more generously than the drugs’ FDA label indications, meaning that the plan covered the drug for a broader population than that described in the FDA approved indication (Figure 1).

Figure 1: US Commercial payer coverage restrictiveness for Accelerated Approval drugs, April 2023 (n=1,206 coverage policies)

Step therapy requirements

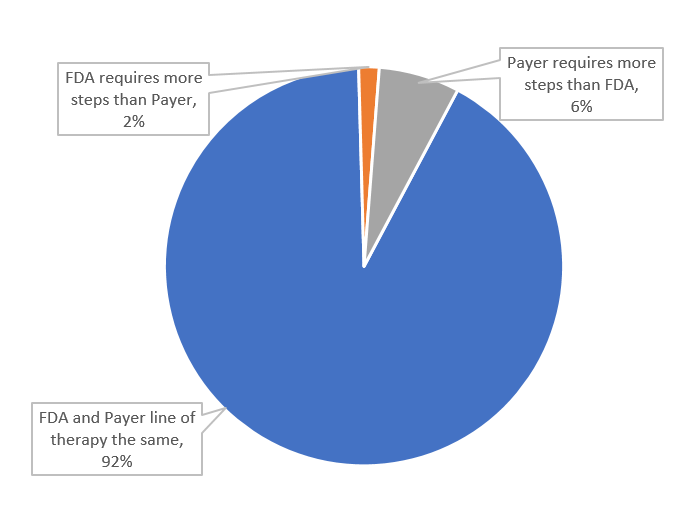

Of the included 1,206 coverage policies, 83 (7%) included step therapy protocols, as such, step therapy requirements were most often consistent with the FDA label (92%). Overall, payers required additional steps beyond the FDA label in 6% (n= 79) of coverage policies, and payers more generous with their step therapy requirements—requiring fewer steps than the FDA label—in just 2% (n=20) of policies (Figure 2).

Figure 2: US Commercial payer step therapy requirements for Accelerated Approval drugs, April 2023 (n=1,206 coverage policies)

Oncology vs. non-oncology

Payers were more likely to cover oncology drugs (<99%) than non-oncology drugs (80%) [e.g., drugs indicated for muscular dystrophy]. Aduhelm (indicated for Alzheimer’s disease) was the drug most often not covered by plans in our sample (12/14 policies, 86%).

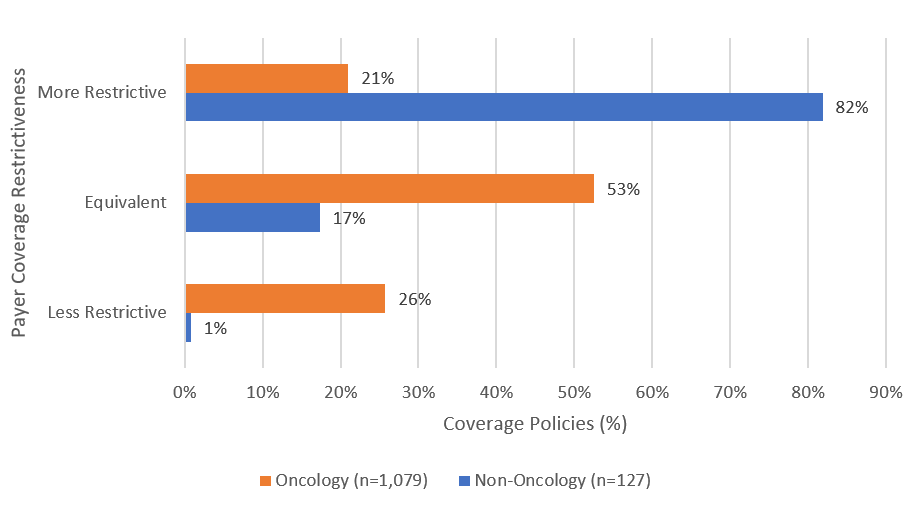

Payers covered oncology drugs with restrictions beyond the drugs’ FDA labels less often than they did so for non-oncology drugs, 21% vs. 82% (Figure 3).

For five non-oncology drugs Amondys 45, Exondys 51, Viltepso, and Vyondys 53, plans imposed restrictions beyond the FDA label indication 100% of the time. Oncology drugs Gavreto, Alecensa, Balversa, Tagrisso, and Blincyto were the most often covered drugs with fewer restrictions than the FDA label across the entire sample (86%).

Figure 3: US Commercial payer step therapy requirements for Accelerated Approval drugs, April 2023 (n=1,206 coverage policies)

Orphan vs. non-orphan

Payers issued non-coverage policies for orphan and non-orphan drugs with similar frequencies, 2% vs. 3%, respectively. Overall, orphan drugs were more often covered with more restrictions than the FDA label (32%) than non-orphan drugs (20%) (Figure 4).

Figure 4: US Commercial payer coverage restrictiveness for Accelerated Approval drugs (Orphan vs. Non-Orphan), April 2023

Conclusions

Our analysis indicates that, despite criticisms of the AA program, health plans frequently permit their enrollees’ access to AA drugs through coverage policies. When plans do impose coverage limits on AA drugs it is typically for non-oncology and/or orphan drugs.

While payers’ willingness to provide coverage ensures that patients with unmet medical need have access to treatment options, there are concerns that the lack of evidence behind AA program drugs can compromise patient quality of care with significant delays in withdrawal for non-effective drugs. While the burden ultimately falls on the FDA, with many including the Medicare Payment Advisory Commission (MedPAC) calling for stricter regulation and cost reductions, payers ultimately bear much of the weight in providing access to these controversial drugs. Currently, payers lack the independence to deviate from FDA guidance on AA drugs, calling into question how potential program reform will impact payer behavior down the line.

More on the Specialty Drug Evidence and Coverage (SPEC) Database

The Tufts Medical Center Specialty Drug Evidence and Coverage (SPEC) Database is a first-of-its-kind resource designed to enhance the transparency of commercial health plan specialty drug coverage. SPEC draws on publicly available medical and pharmacy coverage policies issued by 18 of the largest commercial health plans. Health plans in SPEC cover roughly 170 million lives, or 70% of the market. SPEC includes 399 drugs manufactured by 105 different pharmaceutical and biotech companies. We keep SPEC timely by updating its contents every four months. SPEC includes information on three principal components: (1) health plan coverage decisions, (2) the evidence health plans cite in their coverage policies, and (3) specialty drug attributes.

Access to SPEC is through the CEVR Sponsorship program. Access to the online search portal of the SPEC database is also available for individuals from academic organizations for non-commercial use of the data. Contact James Chambers (jchambers@tuftsmedicalcenter.org) for more information.

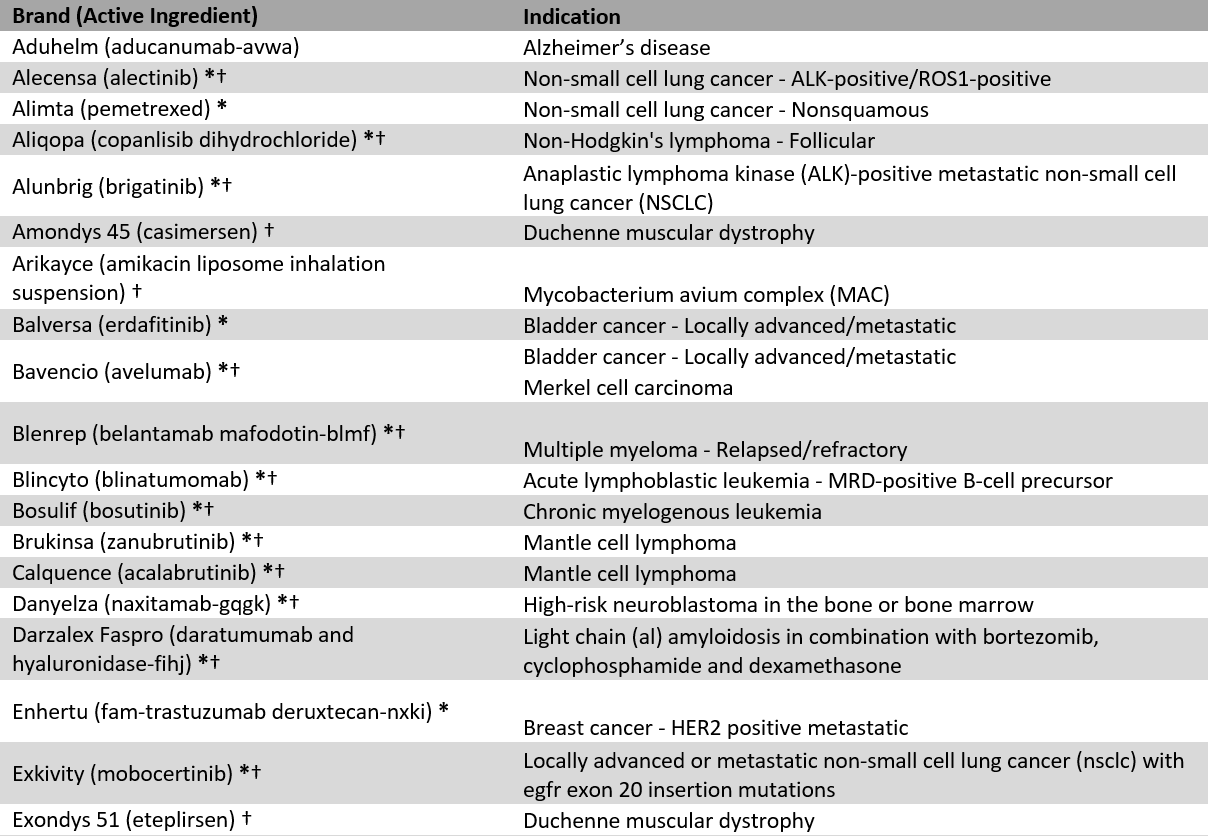

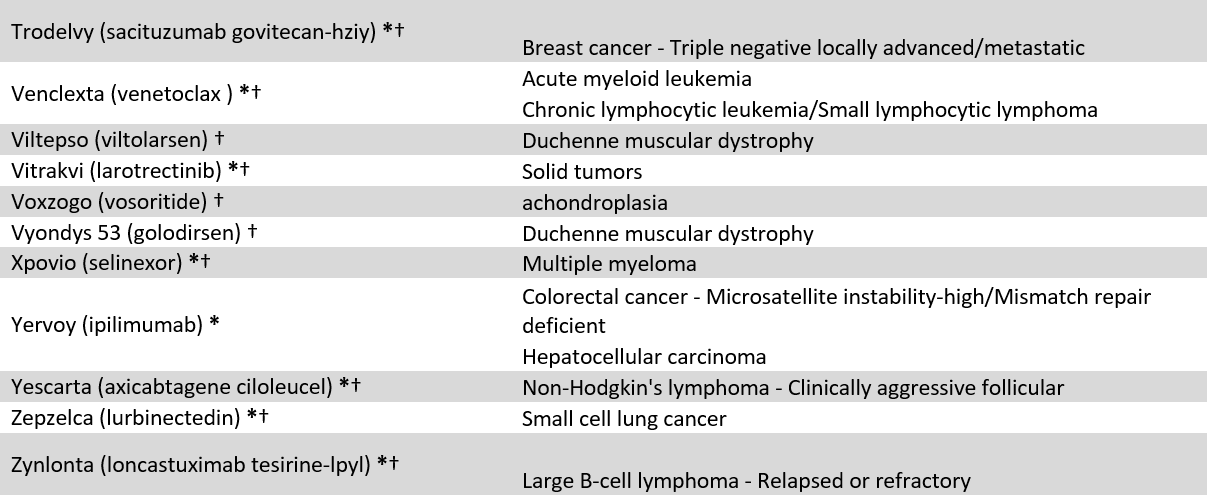

Appendix 1: Included Accelerated Approval drugs and indications

* = Cancer designation, † = Orphan designation